Starting a business in Nigeria is an exciting venture, but it requires careful planning and execution to ensure long-term financial success. At Faturoti Taiwo & Co., a trusted accounting...

Cash flow is the lifeblood of any business, and for Nigerian business owners, managing it effectively is crucial for survival and growth. In a dynamic economic environment like Nigeria,...

Small and Medium Enterprises (SMEs) play a crucial role in Nigeria’s economy, contributing significantly to job creation and economic growth. However, many SMEs struggle with financial management due to...

Tax compliance is a critical aspect of running a successful business in Nigeria. Yet, many businesses—whether startups, SMEs, or large corporations—fall into common tax pitfalls that can result in...

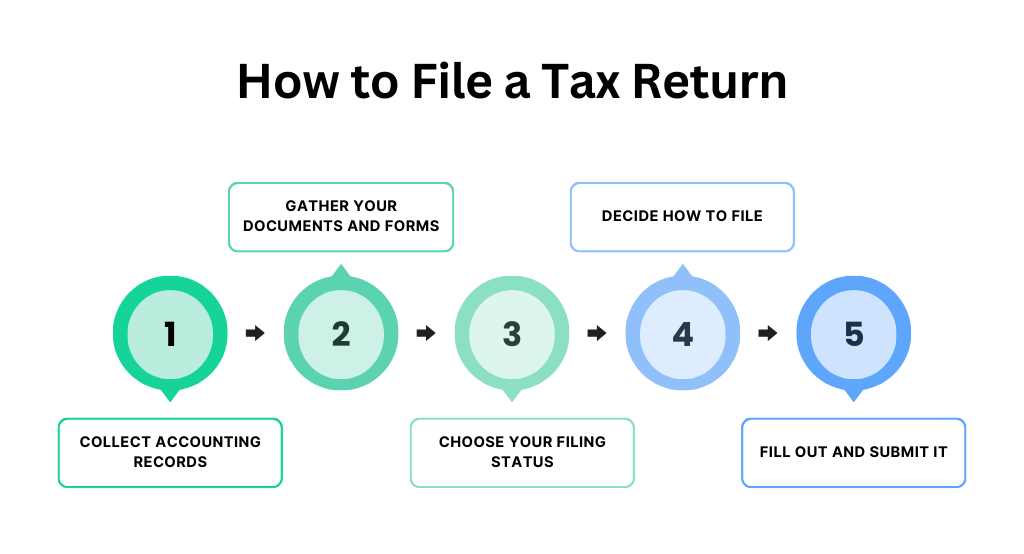

Filing company tax returns in Nigeria is a legal obligation for all registered businesses. Proper tax compliance helps avoid penalties and ensures smooth business operations. This guide will walk...

Nigeria’s business landscape is evolving, making reliable accounting services essential for financial stability and regulatory compliance. Among the top accounting firms in Nigeria, Faturoti Taiwo & Co. has carved...

The Nigerian National Petroleum Company (NNPC) Limited has provided reasons behind the payment of an interim dividend of N123 billion to the Federation Account Allocation Committee (FAAC) for June. ...

The Nigerian Government through the Federal Inland Revenue Service, FIRS, announced the VAT Direct Initiative, a scheme that would enable FG to collect Value Added Taxes from the informal...

Ekiti state governor, Biodun Oyebanji has said his administration is committed to making the state hub of technology and talent development in the country. Oyebanji explained that the time...

Key highlights Nigeria’s total indebtedness to World Bank rose to $13.9 billion as of December 2022 an increase of $1.5 billion as of December 2021. As of December 2019,...