At Faturoti Taiwo and Co., we help businesses and individuals across Nigeria navigate tax compliance effortlessly. One question we frequently hear is: “Do I really need a Tax Clearance...

Running a small business in Nigeria involves more than just turning a profit—you also need to stay compliant with tax laws. One of the most misunderstood but critical tax...

As an entrepreneur in Nigeria, few things are more stressful than receiving an audit notice from FIRS or LIRS. Poor record-keeping and non-compliance can lead to heavy penalties, frozen...

Navigating Nigeria’s tax system can be challenging for businesses, especially when determining whether to file with the Federal Inland Revenue Service (FIRS) or Lagos State Internal Revenue Service (LIRS)....

In today’s fast-paced Nigerian business environment, effective payroll management is critical for compliance, employee satisfaction, and operational efficiency. At Faturoti Taiwo and Co., we provide comprehensive payroll solutions tailored...

Value Added Tax (VAT) is a crucial part of doing business in Nigeria, yet many entrepreneurs struggle with compliance. At Faturoti Taiwo and Co., we help Lagos businesses navigate...

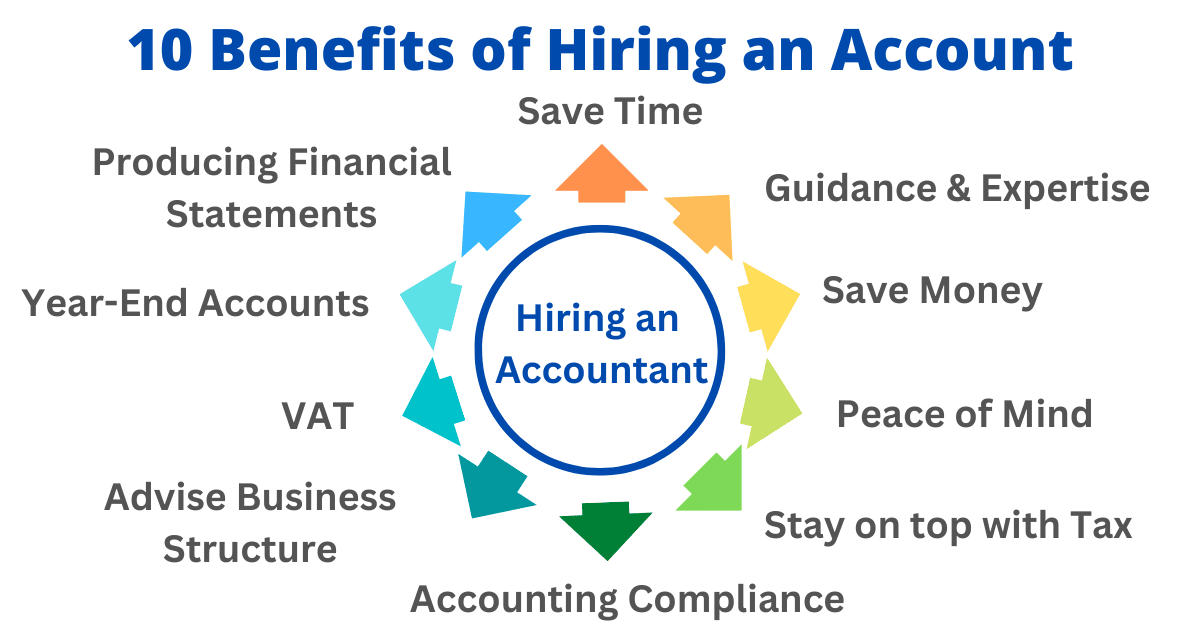

Running a successful business in Nigeria requires more than just a great product or service—it demands strong financial management. Many entrepreneurs try to handle their accounts themselves, but as...

By Faturoti Taiwo and Co. – Trusted Chartered Accountants in Lagos, Nigeria In today’s competitive economy, businesses in Nigeria—especially small and medium-sized enterprises (SMEs)—are seeking ways to not only...

In Nigeria’s dynamic business environment, organizations such as law firms, hospitals, and NGOs require specialized accounting solutions to ensure compliance, financial stability, and operational efficiency. Each sector has unique...

Facing a FIRS (Federal Inland Revenue Service) tax audit can be daunting for any business in Nigeria. However, with proper preparation and expert guidance from Faturoti Taiwo & Co.,...