For Faturoti Taiwo & Co., Chartered Accountants — Lagos, Nigeria Running a small business in Nigeria is already challenging — from rising operating costs to regulatory demands and stiff...

Being self-employed in Nigeria offers incredible freedom — you get to be your own boss, choose your clients, and control your income. But with that freedom comes responsibility, especially...

Staying compliant with the Federal Inland Revenue Service (FIRS) is essential for every Nigerian business. Missing tax deadlines can lead to heavy penalties, interest charges, and unnecessary stress —...

Meeting with an accountant for the first time can feel overwhelming, especially if you are a Nigerian business owner, entrepreneur, or professional who wants to get your finances in...

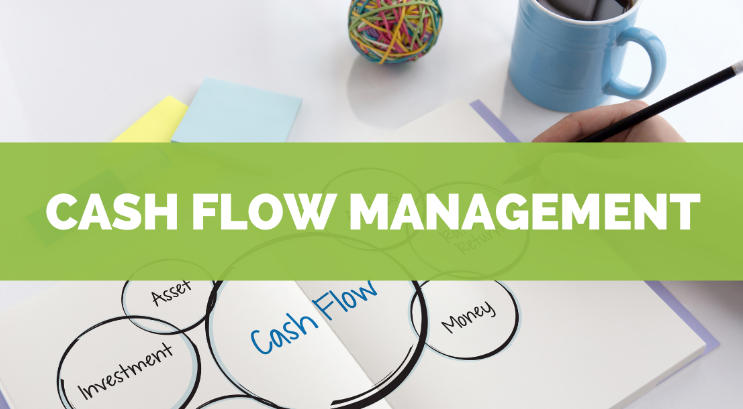

In Nigeria’s fast-changing business environment, cash flow management is one of the most important skills an entrepreneur can develop. Many businesses don’t fail because their product or service is...

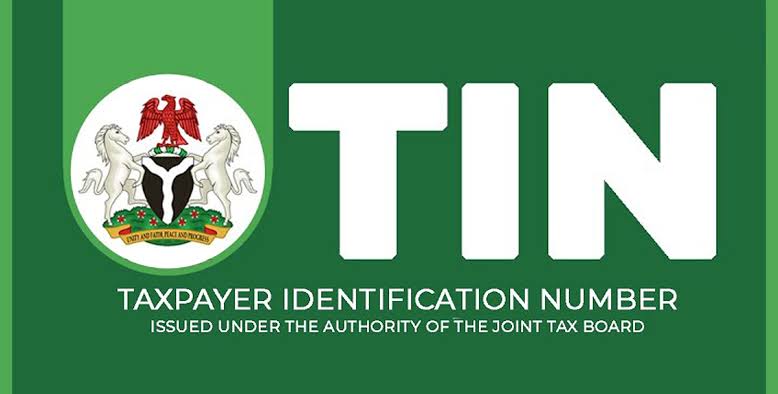

If you own a bank account in Nigeria, you’ll soon need a Tax Identification Number (TIN) to operate it. This new requirement comes into effect on January 1, 2026,...

Every Nigerian who earns an income — whether as an employee, business owner, or professional — is required to pay Personal Income Tax (PIT). Yet, many people are unaware...

Running a business in Nigeria goes far beyond providing products or services. To truly grow and stay competitive, you need the right financial strategy, compliance support, and professional advice....

Running a business in Nigeria requires more than just selling products or services. To stay afloat and grow, companies must comply with government regulations, tax laws, and corporate governance...

Tax compliance is one of the most important responsibilities for businesses and individuals in Nigeria. Missing a filing deadline can lead to penalties, interest charges, and even legal issues...