As Nigerian businesses grow, issues of financial transparency, compliance, and risk management become increasingly important. One key area many business owners struggle to understand is auditing — specifically the difference between internal audit and external audit, and which one their business actually needs.

At Faturoti Taiwo & Co. (FTandCo.), we work with SMEs, large corporations, NGOs, and public-sector organisations across Nigeria to design audit solutions that protect businesses, improve controls, and ensure regulatory compliance.

This guide explains internal vs external audit, their key differences, and how Nigerian businesses can choose the right approach.

What Is an Audit?

An audit is an independent examination of a company’s financial records, systems, and controls to ensure accuracy, compliance, and reliability.

In Nigeria, audits play a critical role in:

- Building trust with investors and lenders

- Meeting regulatory requirements

- Detecting fraud and errors

- Improving financial governance

There are two main types: internal audit and external audit.

What Is an Internal Audit?

An internal audit is an ongoing, in-house (or outsourced) review of a company’s internal controls, processes, and risk management systems.

Key Features of Internal Audit:

- Focuses on operations, controls, and risk

- Conducted regularly (monthly, quarterly, or annually)

- Reports directly to management or the board

- Helps improve efficiency and prevent fraud

What Internal Auditors Review:

✔ Financial processes

✔ Payroll and expense controls

✔ Inventory and asset management

✔ Compliance with company policies

✔ Risk and internal control systems

Who Needs Internal Audit in Nigeria?

- Medium to large companies

- Fast-growing startups

- NGOs and donor-funded organisations

- Companies with complex operations

- Businesses seeking strong corporate governance

What Is an External Audit?

An external audit is an independent review of a company’s financial statements by a licensed audit firm, usually required by law or regulators.

Key Features of External Audit:

- Focuses on financial statements

- Conducted annually

- Required for many registered companies

- Provides an independent audit opinion

In Nigeria, external audits are often required for:

- Limited liability companies

- Companies filing statutory returns

- Organisations seeking loans or investors

- Businesses regulated by government agencies

External audits are commonly required by bodies such as:

- Corporate Affairs Commission

- Federal Inland Revenue Service

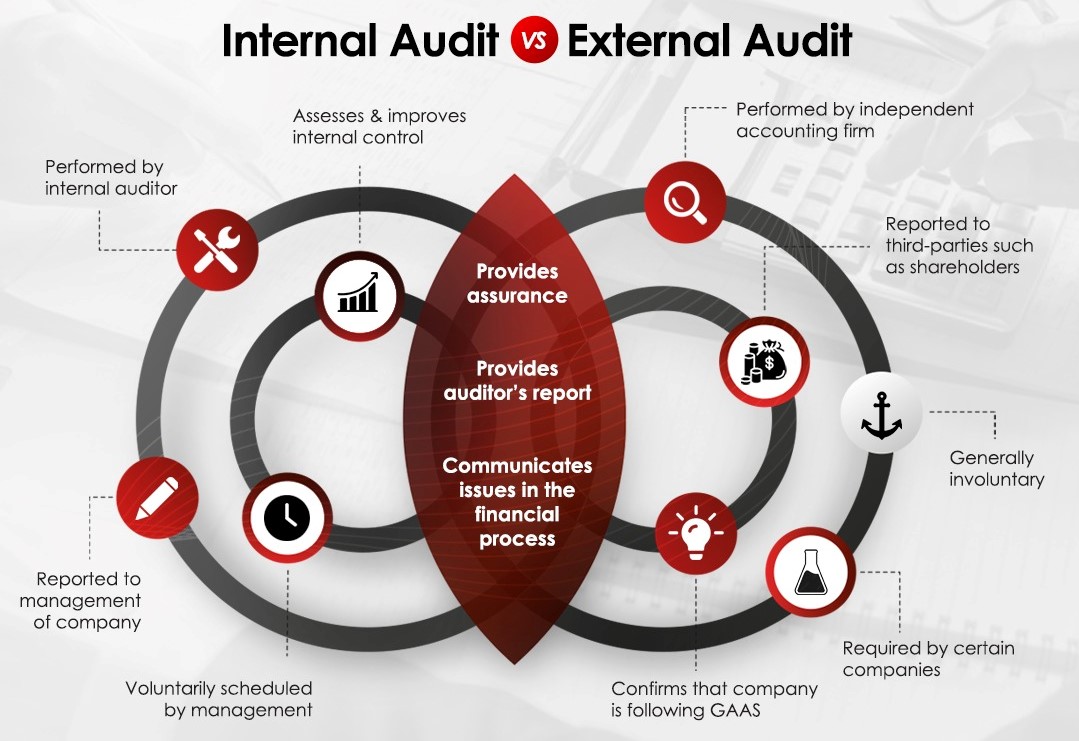

Internal Audit vs External Audit: Key Differences

| Area | Internal Audit | External Audit |

|---|---|---|

| Purpose | Improve controls & operations | Verify financial statements |

| Frequency | Continuous or periodic | Annual |

| Reporting | Management / Board | Shareholders / Regulators |

| Focus | Risk, controls, efficiency | Accuracy & compliance |

| Legal Requirement | Optional (but recommended) | Often mandatory |

Do Nigerian Businesses Need Both?

In many cases, yes.

- Internal audit helps prevent problems before they occur

- External audit confirms financial credibility and compliance

Businesses with strong internal audit systems often experience:

✔ Fewer audit issues

✔ Lower fraud risk

✔ Faster external audit processes

✔ Better regulatory compliance

Common Audit Mistakes Nigerian Businesses Make

Waiting until year-end to review records

Treating audits as a “box-ticking” exercise

Poor documentation and record-keeping

Weak internal controls

Not acting on audit recommendations

These mistakes can lead to penalties, failed audits, or loss of stakeholder confidence.

How Faturoti Taiwo & Co. Supports Nigerian Businesses

At FTandCo., we provide both internal and external audit services tailored to Nigerian regulations and industry realities.

Our audit services include:

- Internal audit design and execution

- External audit and statutory reporting

- Risk assessment and control reviews

- Compliance audits

- Audit preparation and documentation

- Advisory on governance and best practices

We help businesses strengthen controls, meet statutory obligations, and build trust.

How to Decide What Your Business Needs

Ask yourself:

- Are we legally required to have an external audit?

- Do we have risks that need continuous monitoring?

- Are our internal controls strong enough?

- Do investors or lenders require audited accounts?

A professional assessment can help you decide the most cost-effective approach.

Audits are not just about compliance — they are powerful tools for business improvement, risk management, and credibility.

Understanding the difference between internal and external audit helps Nigerian businesses:

✔ Make informed decisions

✔ Avoid regulatory issues

✔ Improve governance

✔ Build long-term financial stability

With expert guidance from Faturoti Taiwo & Co., you can implement the right audit structure for your business — confidently and compliantly.

Need help deciding which audit your business needs?

Contact Faturoti Taiwo & Co. today for professional audit and advisory support.