Filing company tax returns in Nigeria is a legal obligation for all registered businesses. Proper tax compliance helps avoid penalties and ensures smooth business operations. This guide will walk you through the step-by-step process of filing company tax returns in Nigeria.

Understanding Company Tax in Nigeria

The Federal Inland Revenue Service (FIRS) is responsible for tax administration in Nigeria. Companies are required to file returns for:

- Company Income Tax (CIT) – 30% for large companies, 20% for medium-sized companies, and 0% for small businesses with turnover below N25 million.

- Value Added Tax (VAT) – 7.5% on taxable goods and services.

- Withholding Tax (WHT) – 5-10% depending on the nature of the transaction.

- Education Tax (EDT) – 2.5% of assessable profits for companies in specific industries.

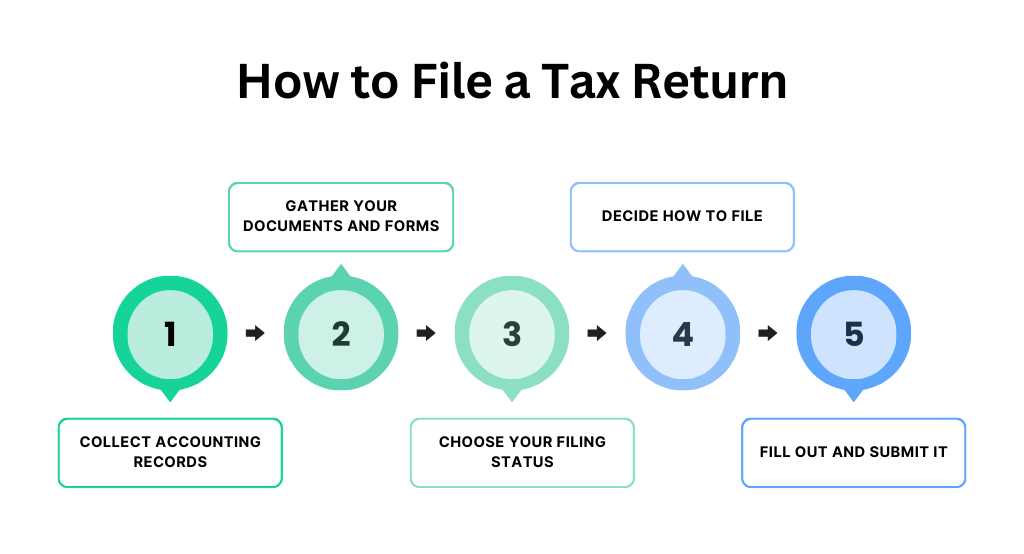

Step-by-Step Process to File Company Tax Returns in Nigeria

Step 1: Register with FIRS

If your company is newly registered, you must obtain a Tax Identification Number (TIN) from FIRS. You can do this through the Joint Tax Board or directly at an FIRS office.

Step 2: Prepare Your Financial Statements

Engage a certified accountant or audit firm to prepare your financial statements, including your balance sheet and profit & loss account. This ensures accurate tax computations.

Step 3: Compute Your Tax Liability

Based on your financial statements, calculate your Company Income Tax (CIT), VAT, and other applicable taxes. You can use the FIRS tax calculator or consult a tax professional.

Step 4: Complete and Submit Tax Returns

Log in to the FIRS TaxPro-Max Portal to complete and submit your tax returns. Alternatively, you can visit the nearest FIRS office with the required documents.

Step 5: Pay Your Taxes

Make payments via:

- Online banking through the FIRS portal

- Bank branches approved by FIRS

- Remita or other government payment platforms

Once payment is made, obtain a receipt as proof of compliance.

Step 6: Obtain Tax Clearance Certificate (TCC)

After filing and payment, you can request a Tax Clearance Certificate (TCC) from FIRS. This is essential for business transactions, tenders, and loan applications.

Deadlines for Filing Company Tax in Nigeria

- Company Income Tax (CIT): Due within six months after the financial year-end.

- Value Added Tax (VAT): Due on or before the 21st of the following month.

- Withholding Tax (WHT): Due within 21 days of deduction.

- Education Tax (EDT): Paid alongside CIT.

Consequences of Late Filing

Failure to file tax returns on time can lead to:

- Penalties & interest charges

- Inability to secure a TCC

- Legal action from FIRS

Filing your company tax returns in Nigeria is a straightforward process if you follow the correct steps. Engaging a professional accounting firm like Faturoti Taiwo & Co. can help ensure compliance and avoid costly mistakes.

For expert assistance with tax filing and compliance, contact us today!