A Practical Guide to Building a Profitable and Compliant Business Starting a business in Nigeria is full of opportunities — but financial mismanagement is one of the leading reasons...

Being self-employed in Nigeria offers incredible freedom — you get to be your own boss, choose your clients, and control your income. But with that freedom comes responsibility, especially...

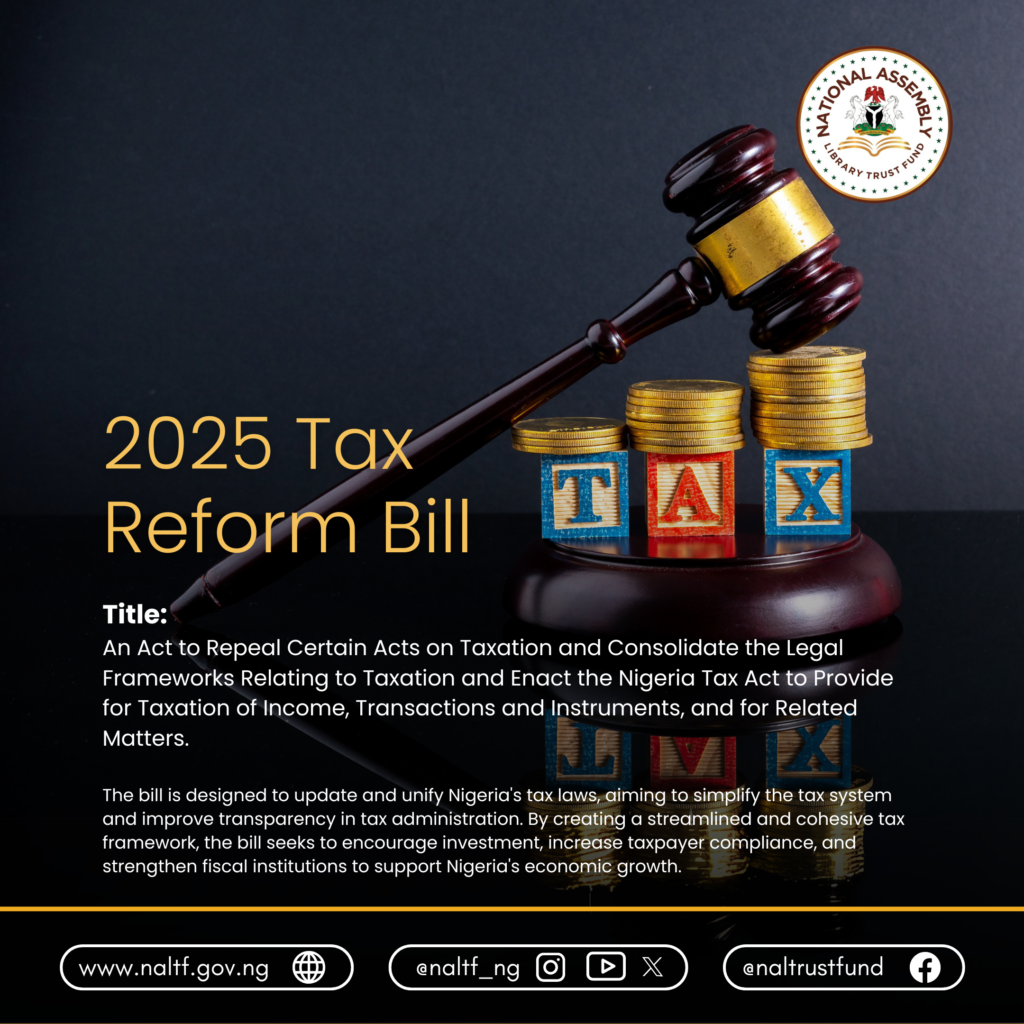

Introduction The Federal Government of Nigeria has taken another decisive step toward modernizing the country’s tax system with the enactment of the Nigerian Tax Reform Acts 2025. This legislation...

Running a small business in Nigeria involves more than just turning a profit—you also need to stay compliant with tax laws. One of the most misunderstood but critical tax...

As an entrepreneur in Nigeria, few things are more stressful than receiving an audit notice from FIRS or LIRS. Poor record-keeping and non-compliance can lead to heavy penalties, frozen...

Facing a FIRS (Federal Inland Revenue Service) tax audit can be daunting for any business in Nigeria. However, with proper preparation and expert guidance from Faturoti Taiwo & Co.,...

The Minister of Finance, Mrs Zainab Ahmed says there might be introduction of new tariffs and levies in 2022 as the economy was now on a recovery path. Ahmed...

Accountant General of the Federation (AuGF), Alhaji Idris Ahmed, yesterday, explained that the implementation of the Treasury Single Account (TSA) has enabled government to maximize scarce resources in the...

With the latest budget release and several CBN intervention fund focused on tackling youth unemployment in Nigeria, the issue is finally being put under the microscope. But funding is...