At Faturoti Taiwo and Co., we’ve helped hundreds of Lagos businesses avoid costly tax penalties through proper compliance. Nigerian tax authorities (FIRS and LIRS) are becoming increasingly strict – this...

Understanding which expenses are tax-deductible can significantly reduce your company’s tax liability and increase profitability. At Faturoti Taiwo and Co., a leading accounting firm based in Lagos, Nigeria, we...

At Faturoti Taiwo and Co., we help Nigerian freelancers and independent professionals understand their tax obligations. One question we frequently hear is: “Do I need to charge and pay...

At Faturoti Taiwo and Co., we help businesses and individuals across Nigeria navigate tax compliance effortlessly. One question we frequently hear is: “Do I really need a Tax Clearance...

Navigating Nigeria’s tax system can be challenging for businesses, especially when determining whether to file with the Federal Inland Revenue Service (FIRS) or Lagos State Internal Revenue Service (LIRS)....

Value Added Tax (VAT) is a crucial part of doing business in Nigeria, yet many entrepreneurs struggle with compliance. At Faturoti Taiwo and Co., we help Lagos businesses navigate...

By Faturoti Taiwo and Co. – Trusted Chartered Accountants in Lagos, Nigeria In today’s competitive economy, businesses in Nigeria—especially small and medium-sized enterprises (SMEs)—are seeking ways to not only...

Tax compliance is a critical aspect of running a successful business in Nigeria. Yet, many businesses—whether startups, SMEs, or large corporations—fall into common tax pitfalls that can result in...

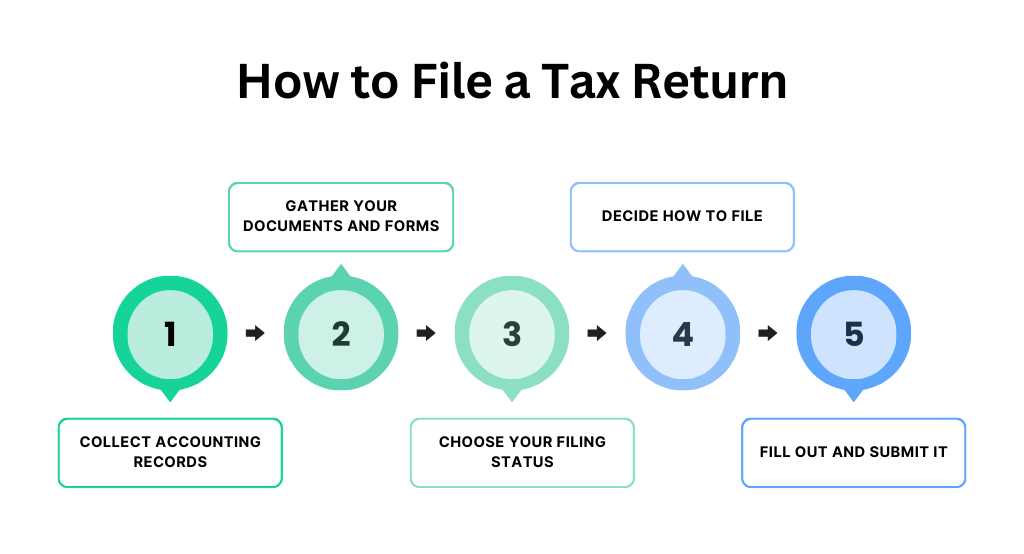

Filing company tax returns in Nigeria is a legal obligation for all registered businesses. Proper tax compliance helps avoid penalties and ensures smooth business operations. This guide will walk...

The Nigerian Government through the Federal Inland Revenue Service, FIRS, announced the VAT Direct Initiative, a scheme that would enable FG to collect Value Added Taxes from the informal...