A Tax Clearance Certificate (TCC) is one of the most important documents for individuals and businesses in Nigeria. Whether you’re applying for a government contract, loan, visa, or corporate...

A Practical Compliance & Planning Guide for New Businesses Tax laws in Nigeria are evolving rapidly, and startups — especially small and medium enterprises (SMEs) — must stay ahead...

A Step-by-Step Guide for Self-Employed Professionals Freelancing is growing rapidly in Nigeria, with thousands of designers, writers, developers, consultants, and digital professionals working independently. But while freelancing offers freedom,...

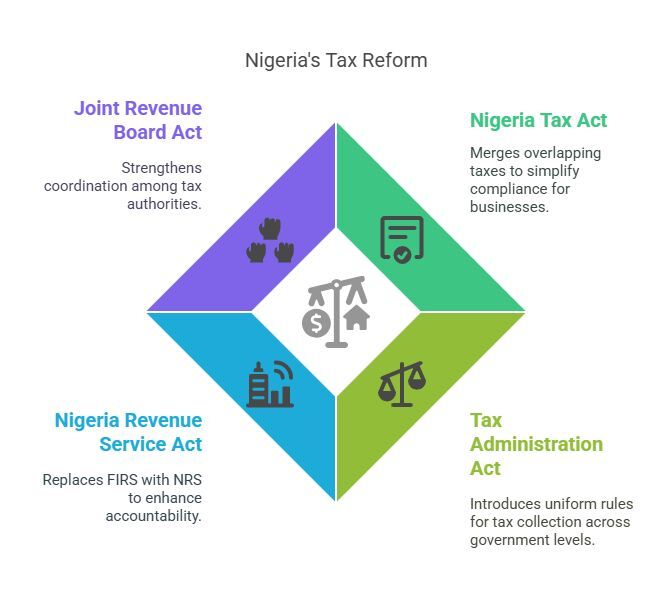

What Nigerian Business Owners Need to Know Now As Nigeria prepares for significant tax reforms in 2026, many businesses are asking the same question:“Are we ready?” The upcoming changes...

Staying compliant with the Federal Inland Revenue Service (FIRS) is essential for every Nigerian business. Missing tax deadlines can lead to heavy penalties, interest charges, and unnecessary stress —...

If you own a bank account in Nigeria, you’ll soon need a Tax Identification Number (TIN) to operate it. This new requirement comes into effect on January 1, 2026,...

Every Nigerian who earns an income — whether as an employee, business owner, or professional — is required to pay Personal Income Tax (PIT). Yet, many people are unaware...

Tax compliance is one of the most important responsibilities for businesses and individuals in Nigeria. Missing a filing deadline can lead to penalties, interest charges, and even legal issues...

If you operate as a sole proprietor in Nigeria, registering for tax is not just a legal requirement — it’s an essential step to keep your business compliant and...

Capital Gains Tax (CGT) is an important consideration when selling property in Nigeria. Many individuals and businesses overlook it—only to face penalties or legal issues later. At Faturoti Taiwo...