Finding the right accounting firm in Lagos can make the difference between a business that merely survives and one that grows confidently and profitably. With increasing tax enforcement, digital...

A Tax Clearance Certificate (TCC) is one of the most important documents for individuals and businesses in Nigeria. Whether you’re applying for a government contract, loan, visa, or corporate...

Starting a business in Nigeria is an exciting move — but how you register and structure your business will significantly affect your tax obligations, compliance requirements, access to funding,...

Tax compliance in Nigeria is no longer optional — and for businesses operating in Lagos and across the country, staying compliant with both federal and state tax authorities is...

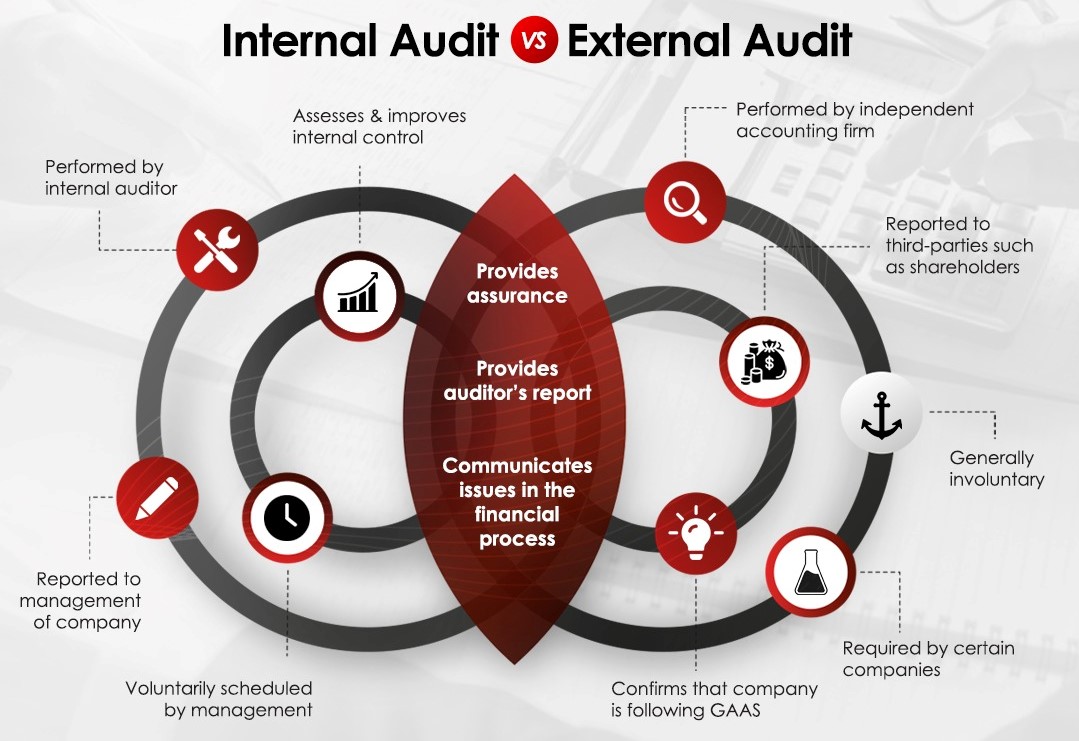

As Nigerian businesses grow, issues of financial transparency, compliance, and risk management become increasingly important. One key area many business owners struggle to understand is auditing — specifically the...

A Practical Compliance & Planning Guide for New Businesses Tax laws in Nigeria are evolving rapidly, and startups — especially small and medium enterprises (SMEs) — must stay ahead...

A Practical Guide to Building a Profitable and Compliant Business Starting a business in Nigeria is full of opportunities — but financial mismanagement is one of the leading reasons...

A Practical Guide for Startups, SMEs & Entrepreneurs Starting a business in Nigeria is an exciting step — but how you register and structure your business can determine whether...

A Step-by-Step Guide for Self-Employed Professionals Freelancing is growing rapidly in Nigeria, with thousands of designers, writers, developers, consultants, and digital professionals working independently. But while freelancing offers freedom,...

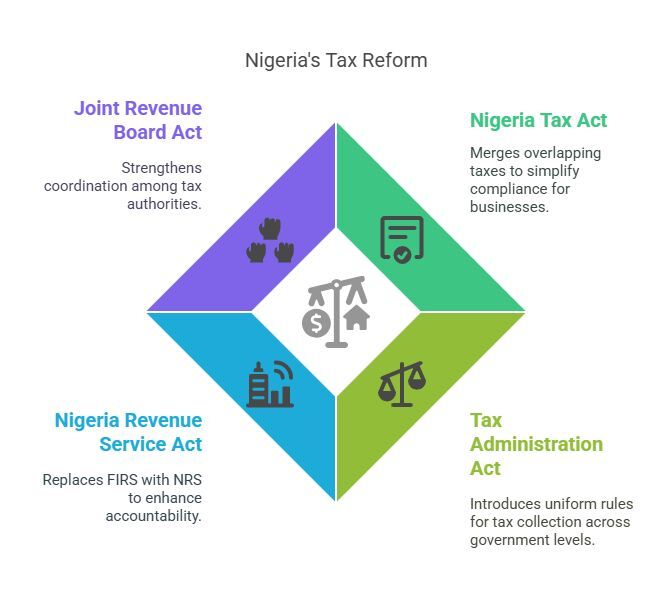

What Nigerian Business Owners Need to Know Now As Nigeria prepares for significant tax reforms in 2026, many businesses are asking the same question:“Are we ready?” The upcoming changes...